As futures contracts expire at a certain date, a continuation chart has to be constructed with data from several futures contracts. The so-called rollover (switch) between one contract and the next can be triggered by different conditions. TeleTrader WorkStation supports both rolling on a fixed date, or rolling based on a rise of open interest and/or volume in the next contract.

Rollovers are always calculated using daily data (end of day data), even when you are using an intraday continuation chart. This means that a rollover will never occur intraday, but always between trading sessions (days).

Rollover triggered by date

You can roll to the next contract on a certain date, often based on the expiration date of the front month contract (the contract that will expire next).

The rollover date must always be a trading day. When the date that you specify (for example, two days before the expiration date), is a non-trading day, such as a holiday or weekend, the rollover will occur on the next trading day after this date.

Note The front month contract is not the same as the current contract. If you choose to display a later contract as the current contract (Forward contract setting is greater than 1), the rollover date will still be calculated based on the expiration date / month of the front month contract.

▪ Right-click on the chart and select Properties.

▪ On the left side of the dialog, select the name of the chart pane, the name of the symbol and then Continuation. For example: Pane 1 > FDAX 2009H,CC > Continuation.

▪ On the right side of the dialog, choose the option Date from the Trigger list.

▪ In the From list, choose whether you want to calculate the rollover date based on the expiration date of the contract, or based on the start or end of the month.

|

Expiration date |

Rollover will occur on or several days before the expiration date of the front month contract. |

|

Start of month |

Rollover will occur several days after the start of the month in which the front month contract expires. |

|

End of month |

Rollover will occur several days before the end of the month in which the front month contract expires. |

▪ In the Number of days field, enter the number of days that should be between the expiration date or start / end of the month and the rollover date. For example, if you want a rollover on the tenth day after the start of the expiration month, enter 10.

Note If the rollover date is calculated based on the expiration date of the contract, the numbers shown will be negative, which means that rollover will occur the specified number of days before the expiration date. If you enter 0, rollover will occur exactly on the expiration date. If you use a later contract as the current contract (Forward contract setting is greater than 1), you can also enter positive numbers, which means that rollover can also occur after the expiration date of the front month contract.

▪ If the rollover date is calculated based on the start or end of the expiration month, you can additionally specify that the rollover will occur one or several months before the expiration month. Enter the number of months in the Months prior field. The default setting is 0, which means that the rollover will occur on the specified date in the expiration month.

Rollover triggered by open interest and/or volume

You can roll to the next contract when the open interest / volume of the next contract after the front month contract exceeds the open interest / volume of the front month contract.

As the rollover date is calculated using daily (end of day) open interest / volume data, the rollover will occur one or two days after the rollover trigger. You can influence the timing of the rollover with the Timing setting (see below).

Note The front month contract is not the same as the current contract. If you choose to display a later contract as the current contract (Forward contract setting is greater than 1), the rollover date will still be based on the open interest / volume of the front month contract (the contract that expires next).

▪ Right-click on the chart and select Properties.

▪ On the left side of the dialog, select the name of the chart pane, the name of the symbol and then Continuation. For example: Pane 1 > FDAX 2009H,CC > Continuation.

▪ On the right side of the dialog, choose an open interest or volume option from the Trigger list:

|

Open Interest |

Rollover will be triggered when the open interest of the next contract is higher than the open interest of the front month contract. |

|

Volume |

Rollover will be triggered when the volume of the next contract is higher than the volume of the front month contract. |

|

Open interest and volume |

Rollover will be triggered when both open interest and volume of the next contract are higher than the open interest and volume of the front month contract. |

|

Open interest or volume |

Rollover will be triggered when either open interest or volume of the next contract are higher than the open interest or volume of the front month contract. |

▪ From the Confirmation list, choose whether one trigger is enough to roll the contract, or if TeleTrader WorkStation should wait for more triggers before rolling to the next contract.

|

Roll on first trigger |

Rollover will occur when the trigger condition is met for the first time. |

|

Roll on second consecutive trigger |

Rollover will occur when the trigger condition is met two times in a row. |

|

Roll on third consecutive trigger |

Rollover will occur when the trigger condition is met three times in a row. |

|

Roll on fourth consecutive trigger |

Rollover will occur when the trigger condition is met four times in a row. |

When the rollover is triggered by open interest or volume, the fact that the chart should be rolled into the next contract is only known at the end of the day, because daily (end of day) open interest / volume data is used to calculate the trigger. This means that the rollover can occur the next trading day at the earliest. When the rollover is done, a rollover bar will be shown on the chart in a different color. The prices of this rollover bar are already the prices of the new contract.

▪ Right-click on the chart and select Properties.

▪ On the left side of the dialog, select the name of the chart pane, the name of the symbol and then Continuation. For example: Pane 1 > FDAX 2009H,CC > Continuation.

▪ On the right side of the dialog, choose an option from the Timing list:

|

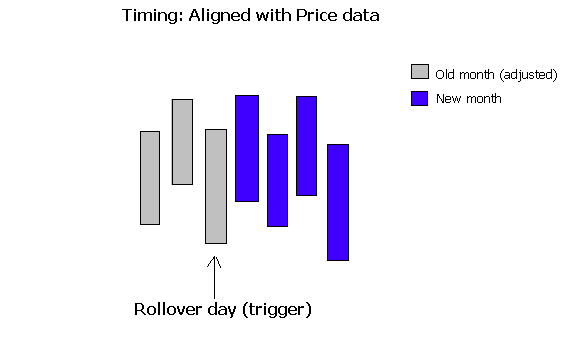

Align with price data |

Rollover will occur on the day after the rollover was triggered with an open interest or volume trigger. The day after the trigger will already start with the Open price of the new contract.

|

|

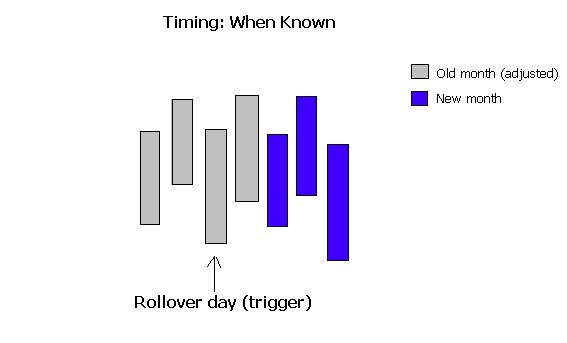

When known |

Rollover will occur two days after the rollover was triggered with an open interest or volume trigger. The day after the trigger will still show the prices of the old contract, the Open price of the new contract will start the following day.

|

|

Date trigger |

|