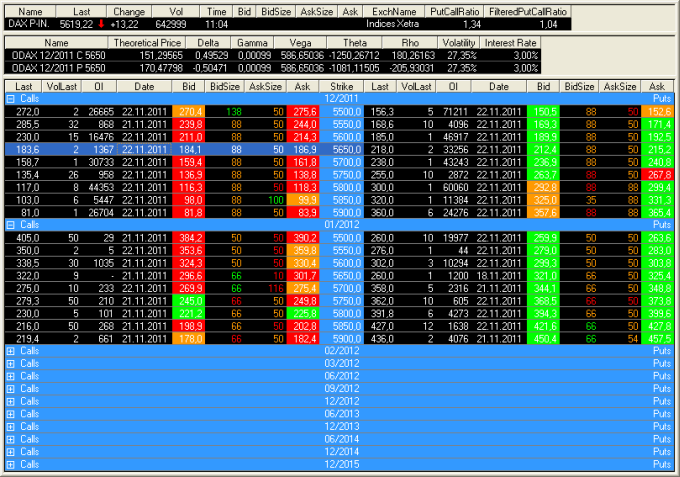

The options matrix shows all options for an underlying symbol

(for example a stock, index or future). The options are grouped by expiration

date or by strike price, with Calls on the left side and Puts on the right side.

Note

Currently the options matrix is only available for options traded on Eurex.

When you try to open an options matrix for an underlying symbol for which

more than one options product is traded on Eurex (e.g. the BASF stock), you can

choose the appropriate options in a dialog (e.g. BASF Options or BASF European Options). To

remember your choice, select the option Always use

this product in the dialog. If you want to see the dialog again later,

press and hold the Shift key while trying to

open an options matrix for this underlying.

You can also easily open a price

page with options symbols / underlyings by using the command Related Symbols. See Opening Related Symbols in a Price

Page.

Underlying view and options matrix view

Information about the underlying symbol is shown on top. Below, the options for this symbol are displayed: Calls on the left and Puts on the right. The column layout in the options matrix view can be mirrored or identical on both sides. You can also change the number of decimal places that is shown for both the underlying and its options.

Learn more:

Showing, Hiding and Changing

Views

Showing, Hiding and Changing

Views

Changing the Number of Decimal

Places

Changing the Number of Decimal

Places

Customizing the Underlying View

Customizing the Underlying View

Customizing the Options Matrix

View

Customizing the Options Matrix

View

Options organized into groups

The options are grouped by their expiration date or by their strike price. Grouping by expiration date is the default setting – in that case, the middle column (shown in the same color as the group headers) displays the available strike prices for the chosen expiration date. The group containing the front month options is expanded automatically – other groups can be expanded or collapsed by double-clicking their group header.

Learn more:

Showing, Hiding and Changing

Views

Showing, Hiding and Changing

Views

Greeks, Put/Call Ratio and filtered Put/Call Ratio

You can show both the so-called "Greeks" and the Put/Call Ratio in the options matrix document. The Greeks (Theoretical Value, Delta, Gamma, Vega, Theta, Rho) for the highlighted options contracts are shown in a separate Greeks view. The current Put/Call Ratio of all options for an underlying is shown as an additional column in the underlying view of the options matrix. You can also add a column showing the filtered Put/Call Ratio there – this ratio is calculated only from the data that is currently visible in the options matrix (taking into account all expanded groups and filter settings).

Learn more:

Showing Greeks and the Put/Call

Ratio

Showing Greeks and the Put/Call

Ratio

Filter by expiration date or strike price

You can choose which expiration dates and strike prices should be visible in the options matrix view.

Learn more:

Filtering Information in the

Options Matrix

Filtering Information in the

Options Matrix

Get notifications when prices change

To get an automatic notification (sound, message or e-mail) when the price of an option reaches a certain level, use price alerts.

Learn more: